Enrollment with Zelle® through Wells Fargo Online® or Wells Fargo Business Online® is required. Transactions between enrolled users typically occur in minutes. For your protection, Zelle® should only be used for sending money to friends, family, or others you trust.

Neither Wells Fargo nor Zelle® offers a protection program for authorized payments made with Zelle®. The Request feature within Zelle® is only available through Wells Fargo using a smartphone. In order to send payment requests to a U.S. mobile number, the mobile number must already be enrolled with Zelle®. To send or receive money with a small business, both parties must be enrolled with Zelle® directly through their financial institution's online or mobile banking experience. For more information, view the Zelle® Transfer Service Addendum to the Wells Fargo Online Access Agreement.

Transactions typically occur in minutes when the recipient's email address or U.S. mobile number is already enrolled with Zelle®. The Request feature within Zelle® is only available through Wells Fargo using a smartphone, and may not be available for use with all small business accounts at this time. To send money to or receive money from an eligible small business, a consumer must be enrolled with Zelle® through their financial institution. Small businesses are not able to enroll in the Zelle® app, and cannot receive payments from consumers enrolled in the Zelle® app. For more information, view the Zelle® Transfer Service Addendum to Wells Fargo's Online Access Agreement.

Other software companies realized that there was potential to become the platform of choice for customers to do their banking. Prodigy, owned by Sears, offered a secure network that Wells Fargo and other banks and businesses allowed to access their own company computer systems. Customers using the Prodigy service were able to access their bank accounts from the comfort of home for the first time.

They could also transfer money, read news, play games, and even order groceries online using the community bulletin feature. Customers had to buy a software package and pay a monthly fee for their software's subscription in addition to any fees charged by their bank. Customers had to use floppy disks and dial up modems to connect to their information. Wells Fargo started offering online account access through Prodigy in 1989, and by the mid-1990s it found that only about 10,000 of its 3.5 million customers used the service.

This account carries a $12 monthly service fee, which is waived by maintaining a $3,500 minimum daily balance each statement period. Platinum Savings account holders can receive a complimentary debit card, a perk that isn't common with savings accounts. Wells Fargo also touts the use of your Way2Save account as a method of overdraft protection for customers who also have checking accounts.

If you sign up for this optional service, Wells Fargo will transfer money from your Way2Save account into your checking account to cover an overdraft. However, this service doesn't prevent you from being charged a $12.50 overdraft fee once per business day. The fee can be avoided if a covering transfer or deposit is made on the same business day.

A key part of Wells Fargo's business strategy is cross-selling, the practice of encouraging existing customers to buy additional banking services. Customers inquiring about their checking account balance may be pitched mortgage deals and mortgage holders may be pitched credit card offers in an attempt to increase the customer's profitability to the bank. Other banks have attempted to emulate Wells Fargo's cross-selling practices . In September 2016, Wells Fargo was issued a combined total of $185 million in fines for opening over 1.5 million checking and savings accounts and 500,000 credit cards on behalf of customers without their consent. The scandal was caused by an incentive-compensation program for employees to create new accounts.

It led to the firing of nearly 5,300 employees and $5 million being set aside for customer refunds on fees for accounts the customers never wanted. Carrie Tolstedt, who headed the department, retired in July 2016 and received $124.6 million in stock, options, and restricted Wells Fargo shares as a retirement package. In addition, Wells Fargo automatically waives the monthly fee for account holders under the age of 24. Turning off your card is not a replacement for reporting your card lost or stolen. Contact us immediately if you believe that unauthorized transactions have been made.

Turning your card off will not stop card transactions presented as recurring transactions or the posting of refunds, reversals, or credit adjustments to your account. Any digital card numbers linked to the card will also be turned off. For debit cards, turning off your card will not stop transactions using other cards linked to your deposit account. For credit cards, turning off your card will turn off all cards associated with your credit card account. Availability may be affected by your mobile carrier's coverage area.

"We apologize to our customers who may be experiencing an issue with our online banking and mobile app," Wells Fargo tweeted. "Thanks for your patience while we research this issue. If you are impacted, please check back here for updates." Enrollment in Wells Fargo Online® Wires is required, and terms and conditions apply. Applicable outgoing or incoming wire transfer service fees apply, unless waived by the terms of your account. Wells Fargo Online Wires are unavailable through a tablet device using the Wells Fargo Mobile® app.

To send a wire, sign on at wellsfargo.com via your tablet or desktop computer, or sign on to the Wells Fargo Mobile app using your smartphone. For more information, view the Wells Fargo Wire Transfers Terms and Conditions. Access available online account statements with permission from Wells Fargo customers with credit cards, trust accounts, lines of credit, employee sponsorship and retirement loans, or rewards accounts. Another savings encouragement is the Save As You Go® transfer, which moves $1 from your Wells Fargo checking account to your Way2Save account with each qualifying transaction. These transactions include any non-recurring debit card purchases and any time you pay a bill using the Wells Fargo online bill pay option.

Though it's a savings account, you have the ability to write checks from this account as long as you have the sufficient funds in the account. You can also link this account to a regular Wells Fargo checking account for overdraft protection. Capital One also has a 360 Performance Savings Account that boasts a 0.4% APY. These rates are far higher than what you can earn with any Wells Fargo product, at any balance.

If you're willing to give up banking in person, Capital One's bank accounts may present better value than Wells Fargo. Wells Fargo offers several other products and services outside of its personal deposit accounts. The bank offers many credit cards, including several popular rewards and cash back credit cards. You can check account balances, pay bills, or transfer funds; quickly find an ATM or branch location; receive and send money with people you know and trust using Zelle®; and receive alerts to track your account activity. The bank announced a number of actions and remedies, several of which had been put in place in preceding years.

The company hired an independent consulting firm to review all account openings since 2011 to identify potentially unauthorized accounts. $2.6 million was refunded to customers for fees associated with those accounts. Carrie Tolstedt, who led the retail banking division, retired. Wells Fargo eliminated product sales goals and reconfigured branch-level incentives to emphasize customer service rather than cross-sell metrics. The company also developed new procedures for verifying account openings and introduced additional training and control mechanisms to prevent violations.

The account comes with access to Wells Fargo Mobile app, a debit card with chip technology, budgeting, cash flow and spending tools, online bill pay and 24/7 customer service. This bank offers some rare benefits, like a debit card for your savings account and discounts on loans to customers with multiple accounts. Customers looking for a well-established and well-rounded financial institution may do well with Wells Fargo. Not only does this bank possess a large geographic footprint, but it also has every type of account, product and service you may need — a true one-stop banking shop. Add in the fact that you can enjoy some relationship bonuses for linking multiple accounts or products under the Wells Fargo umbrella and this institution is a clear winner for anyone who values efficiency and streamlined banking experience. That said, Wells Fargo has not yet earned back the public's trust after the revelations from 2016 to 2018, of a series of systemic fraudulent practices that victimized its own clients for nearly two decades.

While it is relatively easy to avoid the monthly fee, make sure you're aware of the other charges you may face, including a $2.50 out-of-network ATM fee and a $35 overdraft fee if you overdraw your account. If you sign up for Overdraft Protection with a linked savings account, you can avoid the painful $35 fee, but you will still have to pony up a $12.50 transfer fee when the money moves from savings to checking. Wells Fargo offers the standard customer service benefits you'd expect with a bank of this size. That includes the option to manage your account over the phone, online, via mobile banking, at an ATM, or a branch location.

It also offers the option to live chat with customer service agents. Wells Fargo customers were unable to use debit cards or access online banking because of a "systems issue" causing "intermittent outages," the company said on Twitter on Thursday morning. Wells Fargo customers on Thursday were unable to use their debit cards or access online banking because of a "systems issue" that caused intermittent outages, the company said.

If you take the time to waive the paper statement fees by switching to online statements, Wells Fargo's monthly fees are slightly better than those at other major banks. However, the real advantage at this bank comes with the large variety of options. For instance, neither Chase nor Bank of America —Wells Fargo's two closest competitors —carry any options specifically marketed to customers whose credit or banking histories prevent them from getting approved for accounts elsewhere. The Wells Fargo Opportunity Checking Account gives such "toxic" bank customers an opportunity to get back into the mainstream banking system. "We're sorry some of our customers may continue to experience an issue with our online banking and mobile app. We're working hard to resolve the matter ASAP and will post additional updates here," the bank tweeted on Feb. 1. Online Banking and Mobile Banking offer convenient methods to access your Wells Bank accounts.

You can perform a variety of banking services online, whether by computer or other internet device. These free services include account information inquiry, statement retrieval, online transfers between accounts, online viewing of transactions and images of your checks, and online bill pay. Wells Fargo's digital team wasn't content with having made history developing a new way to bank. It wanted to create a place where customers could manage all aspects of their financial lives.

Some ideas, like offering horoscopes and used car sales alongside account histories ended quickly with little enthusiasm. Others, like merging all online accounts into one portal with one log in and mobile banking created meaningful improvements to people's lives. The outage Wednesday morning occurred on the first official payment date for customers to receive the third round of stimulus checks from the American Rescue Plan. While the federal government announced last week that it had started processing and distributing the first wave of payments, several banks, including Wells Fargo, had told customers the money wouldn't be available until Wednesday.

Mobile deposit is only available through the Wells Fargo Mobile® app. See Wells Fargo's Online Access Agreement for other terms, conditions, and limitations. Charges may apply, however, for the Wells Fargo Same Day Payments ServiceSM. Please refer to our fees page for fees associated with our online services. Account fees (e.g. monthly service, overdraft) may also apply to your account that you make Bill Pay payments from.

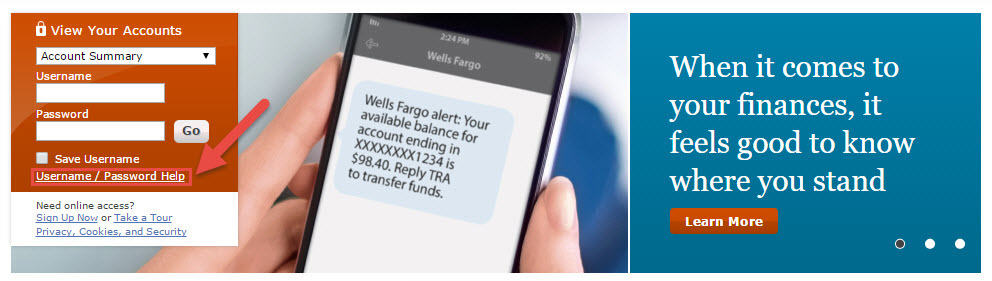

Please refer to the Account Agreement, including the Fee and Information Schedule, applicable to your account. To check your Wells Fargo account online, go to WellsFargo.com and enter your username and password. Your online access applies to any banking accounts you have included in your online banking profile.

Simplify your life and stay in control with the Wells Fargo Mobile® App. Manage your finances; make check deposits, add cards to digital wallet, transfer funds, and pay bills, all within the app. • Quickly access your cash, credit, and investment accounts with Fingerprint Sign On¹ or Biometric Sign on¹. Access your checking, savings and other account information, pay bills, make transfers and more from your mobile device or computer with Wells Fargo Online® and the Wells Fargo Mobile® app.

Once you have your Wells Fargo Online username and password, you can manage your accounts with our Wells Fargo Mobile app or via your mobile browser. Everyday Checking is Wells Fargo Bank's most popular checking account option. This checking account may be ideal for students since the $10 monthly service fee is waived for college students when the primary account owner is 17 to 24 years old. According to Sanjay Gupta, e-commerce executive at Bank of America, the company's 12.6 million online banking customers are 27 percent more profitable than their offline counterparts.

"They carry higher balances, their attrition rate is lower," Mr. Gupta said. "The loyalty effect far exceeds the cost required to serve those customers." A.T.M.'s that replicate services offered on a bank's Internet site could also encourage offline customers to convert to online banking, analysts said. The link does not go to the bank's Web page, but instead lists services that the customer selects by touching the screen. The interest rates at Wells Fargo aren't anything special, but if you're already taking out a loan or using a Wells Fargo checking account, it won't hurt to have a savings account there as well. With the more basic Way2Save Savings Account and Opportunity Savings, either a $300 daily balance or a $25 automatic transfer from your Wells Fargo checking account will waive the $5 maintenance fee.

The real cost of keeping your savings with Wells Fargo is that you'll miss out on stronger rates elsewhere. Wells Fargo is one of the oldest financial institutions in the United States. Founded in 1852, Wells Fargo has grown to become one of the largest national banks in America. Wells Fargo maintains a vast physical presence with more than 5,200 bank branches and over 13,000 ATMs spread across the U.S.

The national bank is home to several checking and savings products and many other banking solutions for individuals, businesses and corporations. But some financial institutions, including Wells Fargo and Chase, said it would likely be today before customers received the money. The rush of customers checking their accounts apparently overwhelmed Wells Fargo's online banking system this morning.

Overdraft Protection is an optional service you can add to your checking account by linking up to two eligible accounts . We will use available funds in your linked account to authorize or pay your transactions if you don't have enough money in your checking account. The service is subject to applicable transfer and advance fees. Overdraft Protection is not available for Clear Access Banking℠ accounts. For more information, please refer to the Deposit Account Agreement and Fee and Information Schedule applicable to your account, or visit wellsfargo.com/overdraftservices.

Wells Fargo does not charge a fee to send or receive money with Zelle. However, when using Zelle on a mobile device, your mobile carrier's message and data rates may apply. Manage your banking online or via your mobile device at wellsfargo.com.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.